RBI cuts the repo rate by 75 bps to fight coronavirus

The Reserve Bank of India on Friday has lowered the key Repo Rate by 75 basis points (bps) to 4.4 percent, to help the citizens due to economic slowdown in the wake of the coronavirus outbreak. The reverse repo rate now stands at 4 percent, down 90 bps.

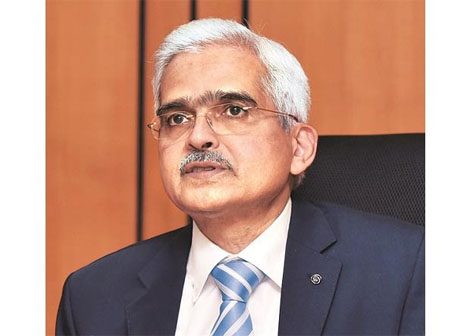

Repo rate is the rate at which a country’s central bank lends money to commercial banks, and the reverse repo rate is the rate at which it borrows from them. The MPC had voted 4-2 in favor of the reduction of the repo rate by 75 bps, RBI Governor Shaktikanta Das said in an address to media. The governor informed that the members of the MPC met on March 24, 26, and 27.

Also See: The Pandemic Conspiracy?

“It is our effort to ensure normal functioning of the market,” Das said. The governor further said that the economic growth and inflation projection would be highly contingent depending on the duration, spread and intensity of the pandemic. “Need of the hour is to shield the economy from the pandemic,” Das added.

Moratorium on the loans

In order to mitigate the burden on debt, servicing had brought about by the disruptions on account of the covid-19 pandemic, several measures has been announced by the central bank that included a moratorium on the term loans, deferring interest payments on working capital, easing of working capital financing, deferment of implementation of the net stable funding ratio, and the last tranche of the capital conservation buffer.

“All commercial banks (including regional rural banks, small finance banks, and local area banks), co-operative banks, all-India Financial Institutions, and NBFCs (including housing finance companies and micro-finance institutions) (“lending institutions”) are being permitted to allow a moratorium of three months on payment of installments in respect of all term loans outstanding as on March 1, 2020,” the statement added.

Also See: NEET UG 2020 postponed due to coronavirus outbreak